This training is strengthening the technical skills of this group of women from the municipalities of San Martin, Colon, Santa Ana, Usulutan, Morazan and San Miguel, in order to encourage them to achieve sustainability of their productive activities, through the proper management of their finances, which will improve the income of their families.

Financial education has become one of the most important learning resources, allowing them to take care of their family assets and develop their economic and family activities, especially for this group of women who, as of today, have better tools for the success of their investments.

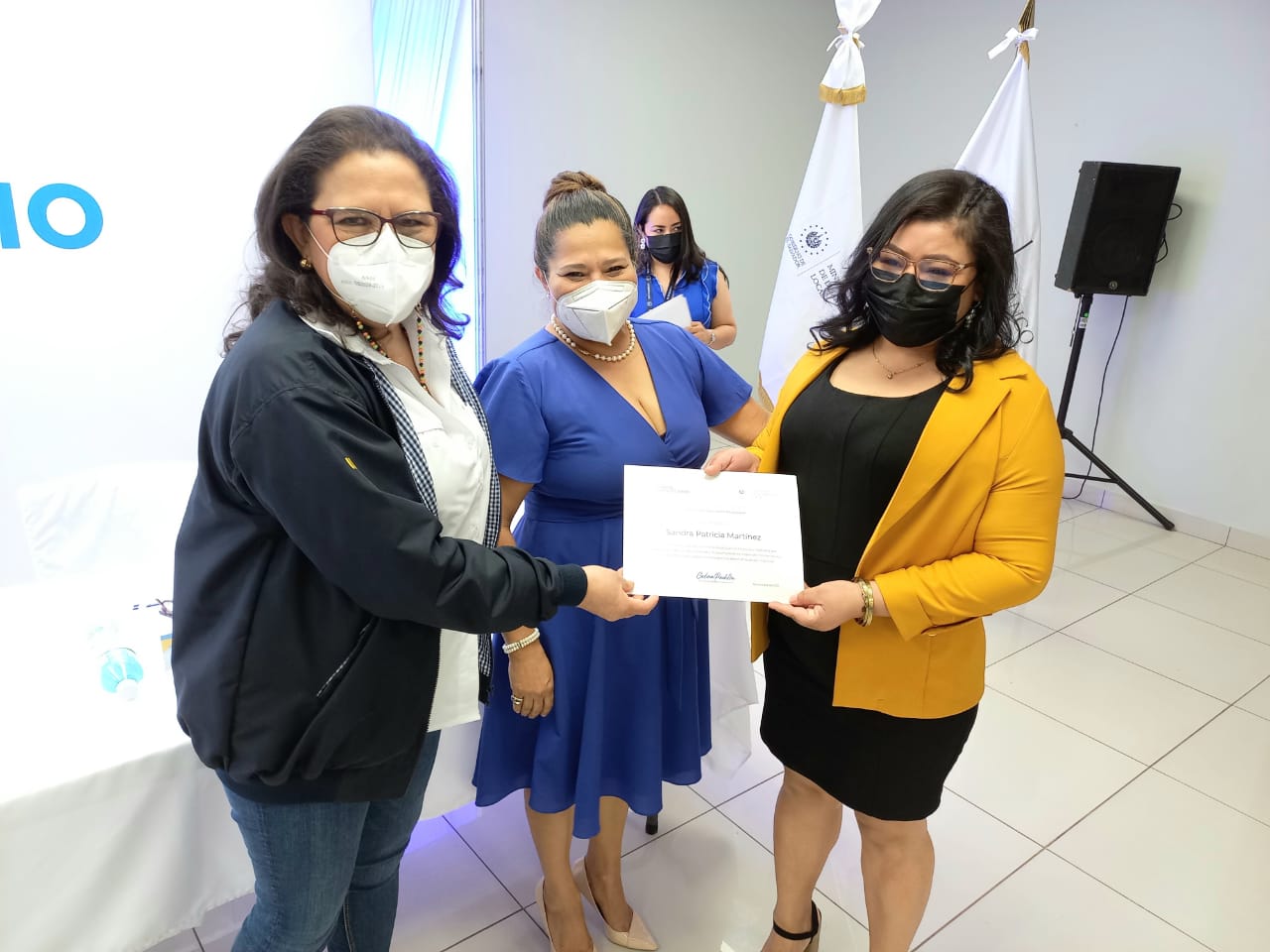

The coordinated work between these institutions made it possible in 2021 to provide 39 workshops in Financial Education, with the participation of this group of entrepreneurs, who were supported by the Program of Integral Attention for Women of the Ministry of Local Development.

The financial education program provided by the bank covered two specific learning areas, the first one: "Know your numbers", in which they learned about key aspects of proper business management, product costing, cash flow, balance sheet and income statement, taking into account different variables of a competitive environment.

Another important topic was "Financial Health", in which they learned about: My home and my money: how to elaborate a personal and family budget; Savings and financial plan: key actions to achieve a savings plan; the good use of credit: identifying available credit options for decision making.

This learning has contributed to their preparation, especially to identify effective decision making and improve the profitability of their enterprises. With financial education, this group of entrepreneurs will strengthen their family economy and grow in their credit category by making good use of their budgets.

The government will continue working to bring development to all sectors and population groups in the country through its different modalities, in order to raise their quality of life and become a benchmark for social growth.

English

English  Español

Español