Filing your income tax return online in El Salvador is a simple process that you can complete from the comfort of your home. Here are the basic steps to do it:

Courtesy

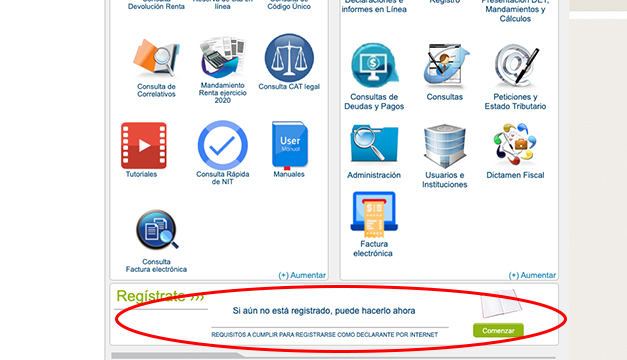

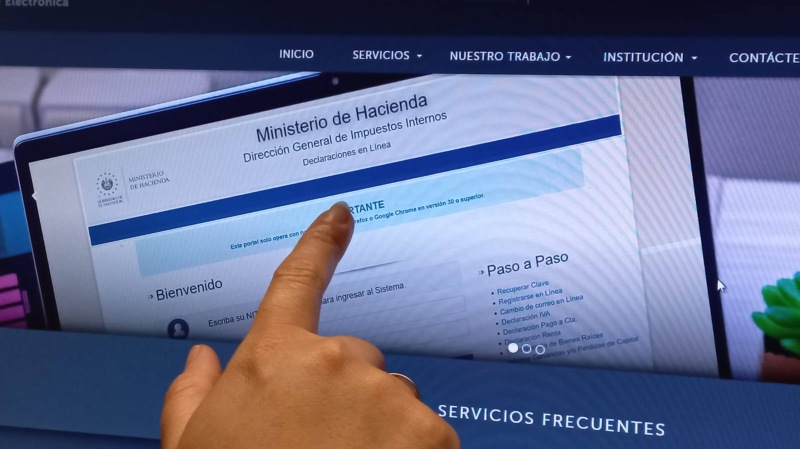

1. Access the Ministry of Finance website: Go to www.mh.gob.sv and select the option “Online Services of the DGII”.

2. Login or register: If this is your first time using the system, register by providing your DUI number and an active email address. If you already have an account, simply enter your DUI and password.

3. Complete your return: The system will show you a suggested return based on the information provided by your withholding agents. Review and, if necessary, update information such as additional income or allowable deductions (medical and educational expenses up to a maximum of $800).

4. File the return: Once you have verified all the information, click on “File Return”. The system will generate a voucher that you can save or print for your records.

5. Make the payment, if applicable: If your return results in an amount to be paid, the system will allow you to generate a payment order that you can pay in authorized banks or through electronic banking.

Remember that the deadline for filing the income tax return is april 30 of each year. It is advisable to do the procedure in advance to avoid inconveniences. If you have any doubts or need additional assistance, you can contact the Ministry of Finance’s attention center at 2244-3444 or asistenciadgii@mh.gob.sv

You may also be interested in

Treasury Department extends schedules for Income Tax Return 2024