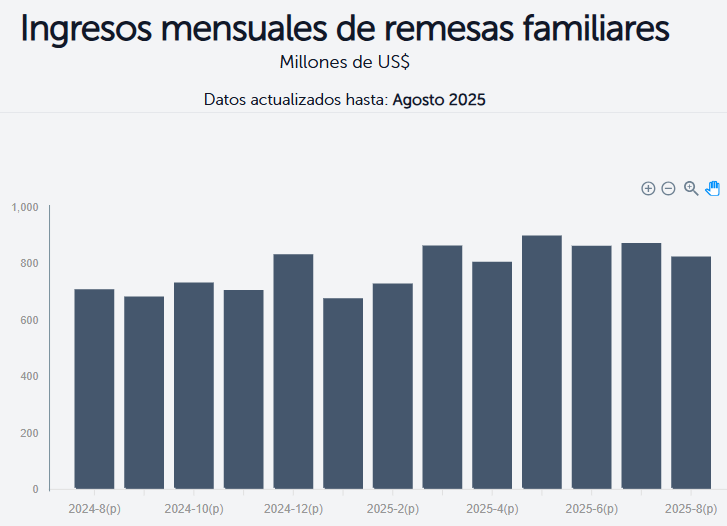

The Banco Central de Reserva de El Salvador (BCR) released the latest report on family remittances received in El Salvador, which totaled US$824.97 million for august 2025.

The highest this year was in may, when a peak of US$899.08 million was reached. Some economists claimed this was due to the imminent threat of some people with illegal immigration status being captured and deported in the United States, thus preventing them from withdrawing their savings from the country.

Cumulative growth

So far this year, US$6,535.16 million has accumulated from january to august, according to the most recent report presented by the BCR.

The government indicates that it is imperative that remittances be used for investment rather than consumption, which has not been a priority for many.

The main sources of information for compiling family remittance statistics are banks, the Federación de Asociaciones Cooperativas de Ahorro y Crédito de El Salvador (FEDECACES), the Federación de Cajas de Crédito y de Bancos de los Trabajadores, S.C. de R.L. de C.V. (FEDECRÉDITO de C.V.),remittance companies with branches in the country, currency exchange offices, and other remittance-paying companies.

A complementary source of information is the results of the biennial survey of family remittance senders residing in the United States, which measures cash remittances arriving in the country.

Monthly data on family remittances for 2005 were revised by incorporating information from remittance companies, and also in 2007 due to the expansion of bank data coverage.

Moreover, since 2005, estimates of remittances sent to the country in cash have been incorporated, based on the cash coefficient of family remittances determined through surveys of remittances sent to the United States. Surveys of remittances are conducted every two years; therefore, the intervening years between surveys are also adjusted to reflect trends in cash receipts.