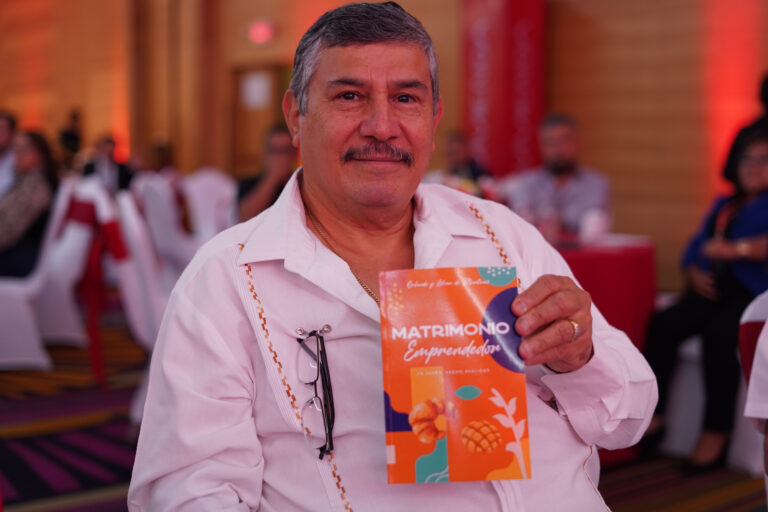

Breakfast at the Davivienda SME Summit at the Hilton Hotel, San Salvador, El Salvador, on september 23, 2025.

Photo: Banco Davivienda Salvador Melendez

Davivienda maintains a firm commitment to supporting SMEs by providing more than just loans, but also support in the digitalization process and the use of technologies as a driver of profitability.

With a firm commitment to continue being a strategic partner for small and medium-sized businesses, Davivienda El Salvador held the SUMMIT Pyme 2025, under the slogan “Digital SME Evolution: Technology that makes money”. This meeting brought together representatives of this segment from across the country with a single objective: to inspire, train, and connect the key players in the sector that sustains the national economy.

The Davivienda SME Summit has established itself as one of the most important platforms for promoting innovation and business growth in El Salvador. This year’s agenda was designed to respond to the emerging needs of the SME ecosystem, with a practical focus on digitalization, business security, and the use of technology as a driver of profitability.

“At Davivienda, we know that business is a process of constant evolution. With this Summit, we seek to strengthen entrepreneurial motivation, enhance our clients’ digital skills, and open new growth opportunities”, said José Ángel López, SME Banking manager at Davivienda El Salvador.

Davivienda’s Support for the SME Sector

Beyond this training space, Davivienda reaffirms its commitment to small and medium-sized businesses through figures that demonstrate its impact:

More than $90 million in loan portfolio aimed at boosting projects and the growth of its clients, and more than $140 million in deposits, supporting the trust of SME clients.

33% of the loans granted to clients in the SME and Business segment are directed to women-led businesses, representing more than $55 million in loans and more than $75 million in deposits.

Currently, PYME Davivienda serves thousands of Salvadoran SME entrepreneurs, providing them with personalized attention through its relationship and support executives, located throughout the country.

The power of digital transformation in business

Believing that entrepreneurs must adapt to a constantly changing environment, Davivienda structured a program with two high-level masterclasses during the Summit. The first addressed the challenges of preventing fraud through social engineering, offering practical advice for SMEs to strengthen their security systems in a context where digitalization also brings new challenges.

The second masterclass focused on the opportunities of generative artificial intelligence, highlighting how this tool is revolutionizing the way businesses operate, scale, and compete in local and international markets.

Also, during the event, the bank held the discussion “Opportunities for Digitalized Businesses,” in which renowned Salvadoran entrepreneurs shared their success stories, marked by resilience, innovation, and adaptability. These voices reflected how Salvadoran SMEs have turned challenges into opportunities, adopting digital tools to innovate, improve their service, and stay relevant in a highly competitive market.

For Davivienda, supporting the SME sector means much more than offering financial products. It means creating experiences and knowledge platforms that strengthen the country’s business fabric. With this vision, the SME Summit becomes a space for entrepreneurs to find solutions, establish strategic contacts, and develop new skills that allow them to grow sustainably.

With this effort, Davivienda reaffirms that digital evolution is not just a trend, but a fundamental strategy for the growth of SMEs in El Salvador, and that the bank will continue to be a staunch ally on this journey toward modernization and success.

Davivienda offers SMEs a comprehensive ecosystem of digital tools to boost their sales and payment solutions through electronic channels and its SME app. Complementing this value proposition, the bank facilitates access to financing through various guarantee programs.

In synergy with Davivienda Seguros, we offer life insurance and business asset protection options. Additionally, Davivienda supports foreign trade operations and offers other services relevant to the growth of SMEs.

For more information about this and other Davivienda El Salvador activities, please visit the website: www.davivienda.com.sv or through its social media channels.

You might also be interested in: