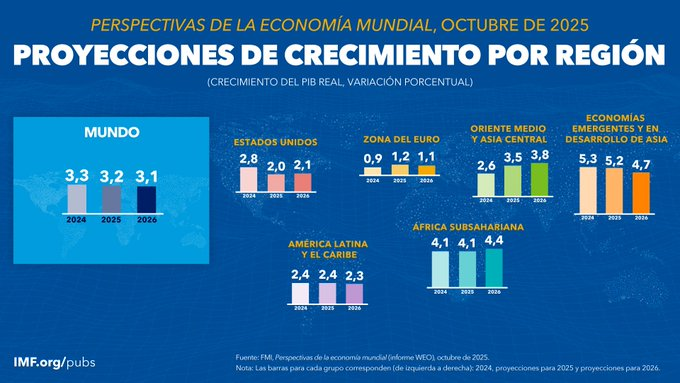

The International Monetary Fund (IMF) estimates that El Salvador will grow 2.6% in 2025, maintaining the pace of expansion achieved in 2024, when the Gross Domestic Product (GDP) closed with a 3.5% increase, according to the most recent World Economic Outlook (October 2025). For 2026, the projection remains around 2.5%, reflecting a panorama of moderate stability, albeit with challenges on the external and fiscal fronts.

Despite the report’s cautious tone, the figures place El Salvador in a position of growth above the Latin American average, where the expansion estimated by the IMF will barely reach 2.4% in 2025. This regional performance is marked by an uncertain international environment, influenced by new US trade policies, a decrease in investment flows to emerging economies, and the slowdown in China.

El Salvador: Stability with vulnerabilities

The IMF emphasizes that salvadoran growth will rely primarily on the dynamism of domestic consumption, driven by family remittances and contained inflation. Remittances continue to represent nearly 25% of the national GDP, providing a significant cushion against the slowdown in global trade.

The organization projects average inflation of 0.9% for 2025, one of the lowest in Latin America, reflecting dollarization, which moderates imported price shocks. However, it warns that the current account will tend toward a slight deficit (-0.8% of GDP), associated with increased imports of consumer goods and fuels.

Meanwhile, the report emphasizes the need for the country to “strengthen fiscal sustainability and maintain control of public debt” in a context where the cost of international financing remains high due to global interest rates.

Central America maintains its resilience

At the regional level, Central America—which includes Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, Nicaragua, and Panama—will grow an average of 3.4% in 2025, following a 3.9% increase in 2024. The projection anticipates that 2026 could see an acceleration to 3.8%, driven by the gradual recovery of tourism, investment in logistics infrastructure, and a moderation in regional inflation close to 1.9%.

Despite the decline in official development assistance and lower capital inflows, the Fund believes that Central America continues to show greater resilience than South America, partly thanks to the diversification of its exports and its proximity to North America. The main risks are expected to come from the reduction in external flows, fiscal vulnerability, and persistent social inequality.

Latin America: Stable but insufficient growth

The IMF report paints a lackluster outlook for Latin America and the Caribbean, with an average expansion of 2.4% in 2025 and 2.3% in 2026. The region continues to be affected by the slowdown in trade and investment, although some countries manage to maintain signs of internal strength.

Mexico, with 1.0% growth next year, is feeling the effects of the new US tariffs, while Brazil will moderate its expansion to 2.4%. In contrast, economies such as Paraguay (4.4%) and Uruguay (2.5%) are benefiting from improved terms of trade and macroeconomic stability.

The IMF emphasizes that Latin America as a whole continues to face a “structural productivity gap,” exacerbated by the fragmentation of value chains and limited public investment. Even so, the organization recognizes signs of gradual recovery in the Caribbean, where tourism is showing a significant rebound.

Global Outlook: A world in economic transition

In its central chapter, the IMF describes 2025 as a year of “tenuously encouraging prospects” and warns that the global economy is entering a phase of adaptation to structural changes: reduced global trade, geopolitical tensions, cuts in international cooperation, and a growing divergence between expansionary fiscal policies and monetary tightening.

Global growth is estimated at 3.2% for 2025, with a slight slowdown in 2026 (3.1%). The report predicts that emerging markets will continue to sustain more than 70% of global growth, while most advanced economies stabilize around 1.6% annually.

Key risks include persistent protectionism, rising sovereign debt, and a decline in aid flows to lower-income countries. However, the Fund also mentions factors that could reverse this outlook, such as accelerated advances in artificial intelligence and more predictable trade agreements.

A call for prudent and predictable policies

The IMF concludes that countries like El Salvador face a dilemma between sustaining the recovery and preserving fiscal balance. It recommended continuing to “attract foreign investment under stable regulatory frameworks, strengthen fiscal transparency, and preserve confidence in the monetary discipline derived from dollarization”.

More broadly, the institution urges Latin American governments to consolidate credible fiscal frameworks, reinforce the independence of central banks, and advance structural policies that promote productivity, education, and digitalization.

In a global scenario dominated by uncertainty, the IMF’s message is clear: El Salvador and Central America have room to continue growing, but only if they manage to transform their stability into sustainable and resilient development.

Read also: