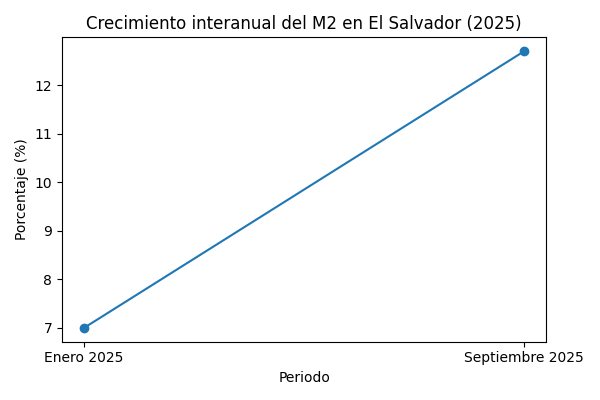

El Salvador registered an acceleration in the growth of broad money (M2) in 2025, an indicator that measures the total amount of money available in the economy, including cash in circulation and public deposits in the financial system. According to information from the Executive Secretariat of the Secretaría Ejecutiva del Consejo Monetario Centroamericano (SECMCA), the year-on-year growth of M2 increased from 7.0% in january to 12.7% in september, reflecting a significant increase in liquidity in the country.

M2 encompasses cash circulating among the population, demand deposits, savings accounts, and time deposits, so its evolution allows for an assessment of the economy’s capacity for consumption, savings, and financing. An increase in this indicator signals that there are more resources available for credit, investment, and productive activity.

According to the SECMCA regional report, this growth is not associated with traditional monetary policy decisions, as El Salvador does not use the interest rate as a control instrument. Instead, the expansion of M2 is primarily due to external flows, such as capital inflows and financing from abroad, which are incorporated into the financial system and increase liquidity.

The increase in money in circulation can benefit the country in the short term by facilitating access to credit for businesses and households, boosting consumption, and supporting economic dynamism. However, the analysis warns that this expansion is not structural, but rather cyclical, due to its dependence on external conditions. A potential reduction in these flows could lead to adjustments in liquidity and the pace of economic growth.

In this context, the growth of M2 represents a positive sign of greater financial activity, but it also poses the challenge of taking advantage of the greater availability of resources to strengthen productive investment and sustainable growth, reducing vulnerability to changes in the international environment.