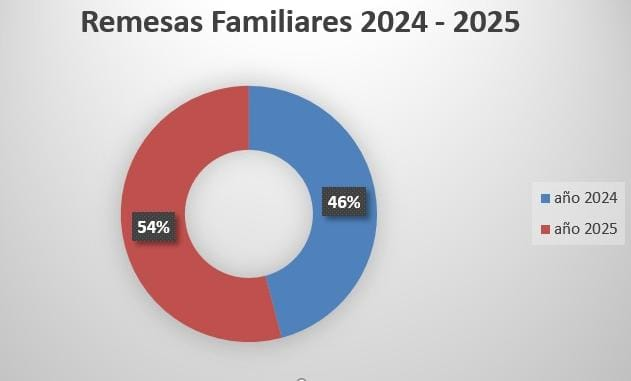

The Banco Central de Reserva (BCR) of El Salvador reported via its online platform that family remittances from 2025 to November were 17.98% higher than in 2024. This increase was driven by higher flows in the months of march, may, july, and october; however, november saw a total of US$815.28 million.

The primary sources of information for compiling family remittance statistics are banks, federations, and other companies dedicated exclusively to remittance payments. The Banco Central de Reserva (BCR) of El Salvador reported that family remittance income reached US$9,021.66 million in the first eleven months of 2025, marking a significant increase compared to the same period in 2024, when US$7,646.97 million was recorded. This performance reflects the strategic importance of remittances to the Salvadoran economy and their ability to boost domestic consumption and investment.

Remittance performance 2024-2025

The 17.98% growth between the two periods represents a notable recovery in foreign exchange inflows. This increase is particularly relevant considering that remittances are one of El Salvador’s main sources of foreign exchange, after exports of goods and services.

During 2024, monthly remittances fluctuated between US$599.85 million in january and US$832.73 million in december, showing an upward trend toward the end of the year. In contrast, the january-november 2025 period has shown greater volatility, with highs of US$899.08 million in may and US$872.50 million in july, while the lows were at US$677.13 million in january.

Monthly patterns and trends

Analysis of the monthly data reveals characteristic seasonal patterns in remittance flows. In 2025, the months with the highest inflows were may (US$899.08 million) and july (US$872.50 million), periods traditionally associated with holidays and special spending. Conversely, january registered the lowest inflow of the year (US$677.13 million), consistent with the reduction in remittances observed in the same month of 2024.

The average monthly remittance in 2025 (through november) was around US$820 million, consistently exceeding the monthly averages of 2024. This stability at higher levels suggests sustained demand for remittance services and greater capacity for sending money from abroad.

Economic implications

The 17.98% increase in remittances during 2025 has positive implications for various sectors of the salvadoran economy. Remittances are primarily used for the consumption of goods and services, which stimulates domestic trade, generates employment in related sectors, and contributes to reducing poverty in recipient households. Additionally, some of these resources are channeled toward investment in housing, education, and small businesses.

This performance also reflects the relative stability of the labor market in the United States, the main source of salvadoran remittances, as well as the continuation of immigration regularization programs that have allowed more salvadorans to work under formal conditions abroad.

The 17.98% year-over-year growth in family remittances during the first eleven months of 2025 demonstrates the continued demand for money transfer services and the commitment of salvadorans living abroad to support their families. This flow of foreign currency remains fundamental to the country’s macroeconomic stability and the well-being of millions of salvadorans who depend on these funds. Economic authorities must continue monitoring this strategic variable and promoting policies that facilitate remittances through formal channels.

You can also read: