Income tax is levied on the earnings of individuals and businesses because of their work, economic activities, or investments. Simply put, it is a contribution paid to the government on a portion of the profits earned during a specific period, usually a year. Its primary purpose is to finance public services and the functioning of the country.

This tax applies to various types of income. For individuals, it includes salaries, professional fees, rent, interest, and other income. For businesses, income tax is calculated on profits earned after deducting the costs and expenses necessary for operation. The law establishes income brackets and differentiated rates, so that those who earn more contribute a larger share, following the principle of tax equity.

The reason for paying income tax is directly linked to financing the government. The resources collected cover expenses in essential areas such as health, education, security, infrastructure, social programs, and emergency response. Without this tax, the State would have less capacity to provide basic services and develop projects that benefit the general population.

Income tax benefits society. Although the tax is collected individually or by businesses, its ultimate destination is collective. The funds are used to maintain hospitals and schools, improve roads, strengthen public safety, and support social assistance programs. In this way, income tax becomes a redistribution mechanism, where the earnings of the productive sector help sustain services that impact all citizens.

Furthermore, income tax plays an important role in formalizing the economy. By declaring income and paying taxes, individuals and businesses strengthen financial transparency and facilitate access to credit, public tenders, and other benefits of the formal system. This contributes to a more orderly and competitive economic environment.

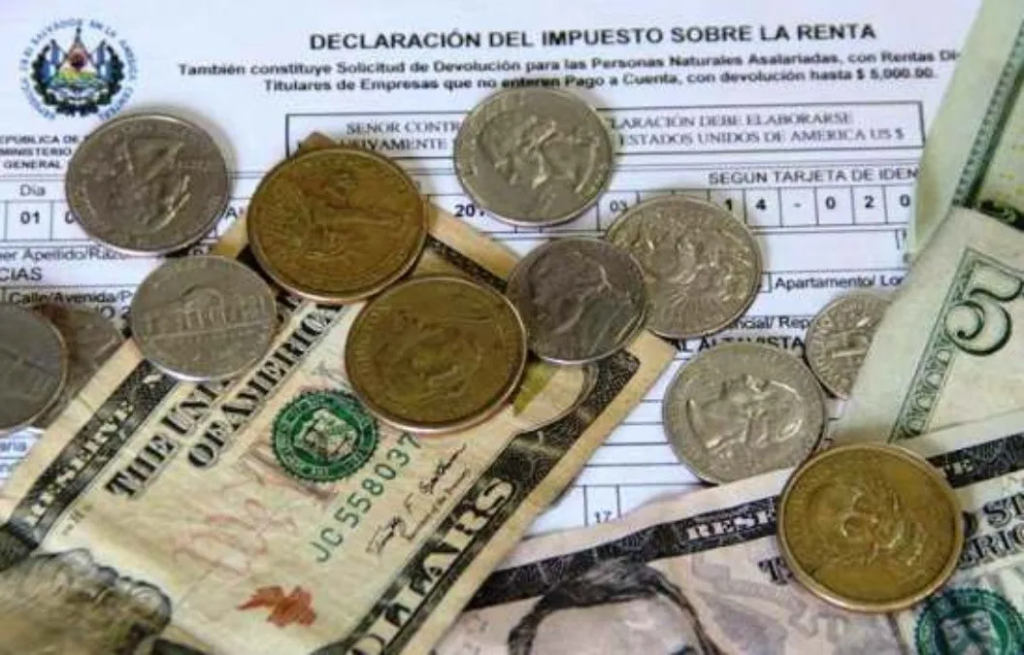

Income tax payments are typically made through an annual tax return, in which income is reported and the amount due is calculated according to the law. In many cases, salaried employees already have a monthly withholding that advances part of the tax, while self-employed professionals and businesses calculate the full amount at the end of the fiscal year.

In short, income tax is a key tax for the functioning of the State and the development of the country. Although it represents an obligation for individual and corporate taxpayers, its revenue allows for the financing of public services, the promotion of equity, and the support of projects that aim to improve the population’s quality of life.

You can also read: