The Banco Central de Reserva (BCR) of El Salvador made a new purchase of 9,298 troy ounces of gold, equivalent to US$50 million, as part of its strategy to strengthen and diversify the country’s international reserves, the institution reported in an official statement.

With this operation, carried out on international markets, the BCR seeks to increase its holdings of the precious metal as a strategic asset, reinforcing El Salvador’s long-term financial strength and macroeconomic stability.

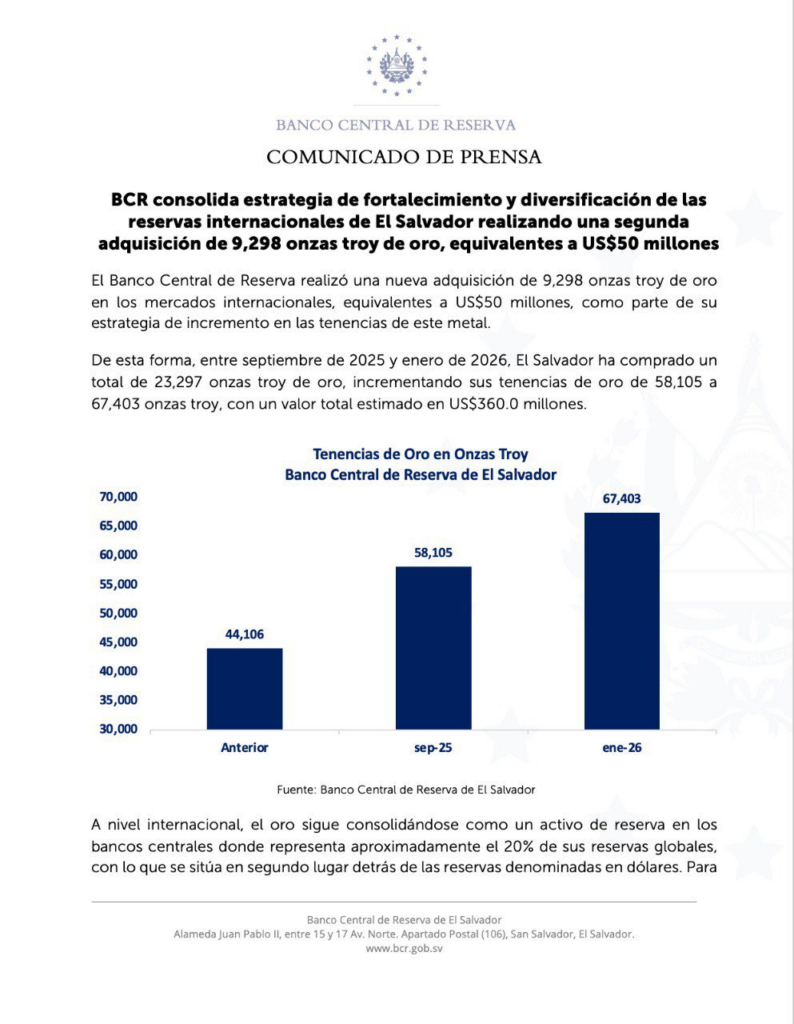

Increase in the country’s gold reserves

The BCR detailed that between september 2025 and january 2026, El Salvador has purchased a total of 23,297 troy ounces of gold, raising the metal’s reserves from 58,105 to 67,403 troy ounces, with an estimated value of US$360 million.

This increase is part of an asset strengthening strategy that seeks to maintain a prudent balance in the composition of the assets that make up the country’s international reserves.

Gold as a strategic asset

According to the Banco Central, gold is considered an asset of universal strategic value, as it helps to support the country’s financial strength, protect the economy from structural changes in international markets, and ensure greater stability and confidence for the population and investors.

Globally, the BCR highlighted that gold represents approximately 20% of Banco Central reserves, ranking as the second most important reserve asset after dollar-denominated reserves.

Context of the BCR’s strategy

The institution explained that this strategy is possible thanks to the strengthening of the Central Bank’s assets and the country’s macroeconomic stability, driven by public policies aimed at growth and strategic decision-making that protect and enhance national welfare.

In addition, this purchase is the second gold acquisition by the BCR since 1990, reflecting a commitment to diversify international reserves and secure assets considered safe and long-term.

Impact on the salvadoran economy

The strengthening of gold reserves seeks to provide greater support to the salvadoran economy in the face of international market volatility, reduce financial risks, and improve the perception of stability in the country among investors and international organizations.

With these actions, the Banco Central de Reserva reaffirms its commitment to maintaining diversified, secure, and sustainable reserves, contributing to the economic and financial stability of El Salvador.

You can also read: