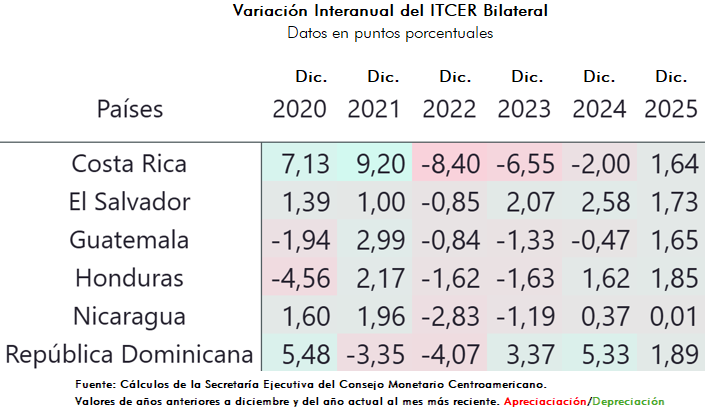

As of december 2025, El Salvador registered a 1.73% real depreciation in the Índice de Tipo de Cambio Efectivo Real (ITCER) with the United States, an indicator that measures the country’s competitiveness against its main trading partner. The data was provided by the Secretaría Ejecutiva del Consejo Monetario Centroamericano (SECMCA) and reflects a moderate loss of real competitiveness associated primarily with inflationary differences between the two countries.

The ITCER does not measure a nominal exchange rate (since El Salvador uses the US dollar), but rather the combined effect of domestic inflation compared to that of the United States. In this context, a real depreciation implies that goods and services produced in the country became relatively cheaper compared to those in the United States, which can favor exports, although it also makes imports more expensive.

Recent evolution of the indicator

According to the SECMCA, the behavior of the ITCER between 2020 and 2025 has been variable. After several years of real appreciation (especially in 2023 and 2024), the 2025 result represents a partial reversal of that trend. The 1.73% depreciation reduces some of the accumulated competitiveness gains observed in previous years, without implying an abrupt or disorderly change.

What explains the depreciation?

In a dollarized country, ITCER movements respond primarily to inflation. During 2025, inflation in El Salvador was higher than that recorded in the United States, which eroded real competitiveness. This was compounded by factors such as slower growth in some export sectors (including textiles and coffee) and an uneven economic recovery following the pandemic.

Effects on the economy

The 1.73% real depreciation has mixed impacts. It improves the position of salvadoran exports to the United States, as products such as coffee, sugar, and manufactured goods become relatively more price competitive. It also benefits inbound tourism, making the destination more attractive to American visitors.

It implies higher real import costs. Essential goods such as fuel, machinery, and production inputs tend to become more expensive, which can put pressure on production costs and household spending, especially on food and consumer goods.

Regional context

El Salvador’s behavior is not isolated. According to the SECMCA, several countries in the region registered similar real depreciations against the United States by the end of 2025, including Costa Rica (1.64%), Guatemala (1.65%), Honduras (1.85%), Nicaragua (0.01%), and the Dominican Republic (1.89%), suggesting a regional adjustment linked to inflation differentials with the US economy.

Overall, the 1.73% real depreciation places El Salvador in a position aligned with its Central American neighbors, with effects that, while presenting challenges in terms of costs and inflation, also open opportunities to strengthen its export performance.

You can also read: