There is only one week left for the end of the Income Tax (ISR) declaration period corresponding to fiscal year 2024, so the Ministry of Finance makes an urgent call to taxpayers to file their returns before april 30 to avoid fines.

Marvin Sorto, General Director of Internal Taxes, reminded that the process is available online through the official website www.mh.gob.sv, both for individuals and legal entities. On the platform, users can access the automatic calculation of income, expenses and withholding taxes.

The “Renta en Línea” tool includes information provided by Withholding Agents, which allows taxpayers to accurately identify taxable income and income subject to declaration, thus facilitating the tax compliance process.

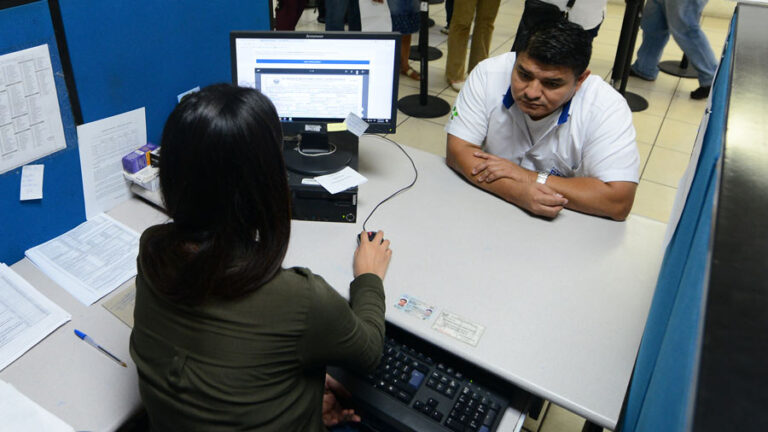

In addition, there is also the option of going to the offices of the Ministry of Finance to comply with this tax duty, to facilitate compliance, the Treasury has established extended hours of service, operating monday through friday until 5:00 p.m. and on saturday, april 26 from 7:30 a.m. until noon, and 17 express service centers with free advice will be available. On april 30, the last day to declare, the offices will be open until midnight to attend the latecomers.

According to Marvin Sorto, a collection of US$635 million is projected for ISR in 2024, surpassing the US$610 million obtained the previous year. Sorto reminded that those who earn US$400 monthly or more are obliged to declare.