According to data from the Banco Central de Reserva (BCR), compiled through the 2025 Encuesta de Inclusión y Educación Financiera 2025, just 20.1% of people in El Salvador have ever saved or contributed to a pension for their old age. Most of those who do have this support do so through Administradoras de Fondos de Pensiones (AFP) and in the case of those already retired, the main use of these resources is for food, personal expenses, and basic services, reflecting that the pension primarily serves a subsistence function.

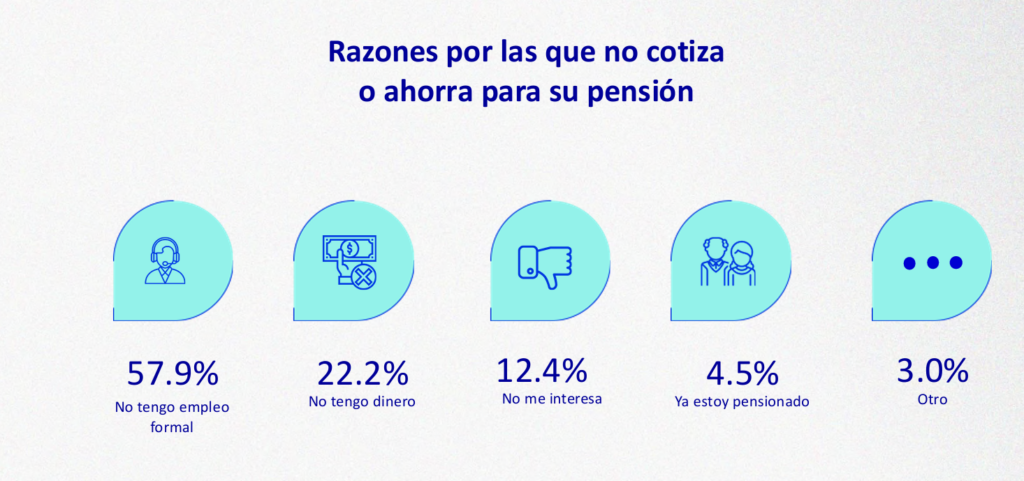

The study shows that, despite the importance of retirement savings, almost eight out of ten people have not managed to contribute or save for their retirement, a situation closely linked to labor market conditions and income levels. The main reason for not contributing to a pension is the lack of formal employment, cited by 57.9% of respondents, followed by insufficient income (22.2%) and disinterest (12.4%).

The gaps are also observed by geographic area and gender. In urban areas, 24.8% of people have saved or contributed to their pension, while in rural areas the figure drops drastically to 8.5%, highlighting a marked territorial inequality in access to old-age protection mechanisms. By gender, men show greater participation than women, although in both cases the proportion remains low.

The analysis by age group shows that the highest level of pension savings is concentrated among people between 26 and 35 years old, with 28.7% reporting having contributed or saved. In contrast, among young people aged 18 to 25, only 18.8% have done so, while among adults aged 61 and over, the figure falls to 9.1%, reflecting high economic vulnerability at this stage of life.

Regarding retirement savings plans, 82.9% of those with some type of savings mechanism use AFPs, significantly more than personal savings (15.1%) or other alternatives such as money kept at home (6.3%). Options like investment funds, job security, or IPSFA have a marginal share.

As for pension use, 90% of retirees allocate these funds to food, personal expenses, or utility payments, followed by healthcare expenses (47%) and emergency or unforeseen expenses (42.4%). To a lesser extent, the funds are used to pay off debts, improve homes, invest in small businesses, or cover family celebrations.

The results of the BCR survey highlight that retirement savings in El Salvador remain limited and highly dependent on informal employment and low incomes. Although there has been progress in access to financial instruments, the data show that ensuring a more economically stable old age continues to be one of the main challenges for large segments of the population.