The Government of El Salvador, through the Ministry of Finance, reported a significant increase in tax collection during the first half of 2025, compared to the same period last year. This improvement is attributed to the implementation of an orderly, disciplined fiscal policy focused on strengthening the country’s public finances. Total tax revenue collected reached US$4,308.8 million, representing US$310.3 million more than in 2024, equivalent to a growth of 7.8%.

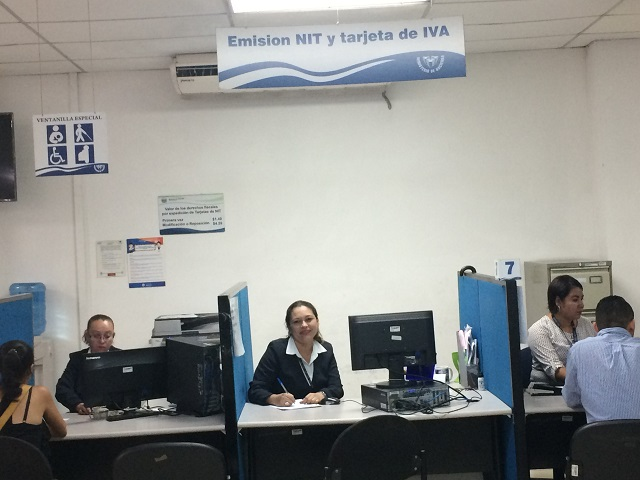

One of the main drivers of this increase has been the collection of the Value Added Tax (VAT), which showed an increase of 8.2%. In monetary terms, this represents US$1,883.2 million collected, or US$142.6 million more than last year. This behavior reflects increased economic activity and consumption, supported by tax control and efficiency measures.

Income Tax (ISR) also showed a positive trend, with accumulated revenue of US$2,023.8 million, 7.3% more than in 2024. This is equivalent to an additional US$137.1 million collected by the State, thanks to increased oversight and voluntary taxpayer compliance.

These results demonstrate the positive impact that a coherent fiscal policy has on the country’s macroeconomic stability. The increase in revenue allows the Government to invest in social programs, infrastructure, education, and health care without resorting to excessive debt.

The Ministry of Finance reaffirmed its commitment to continue strengthening the tax system, ensuring transparency, efficiency, and sustainability in the management of public resources, as part of a comprehensive strategy to further consolidate El Salvador’s economic growth.