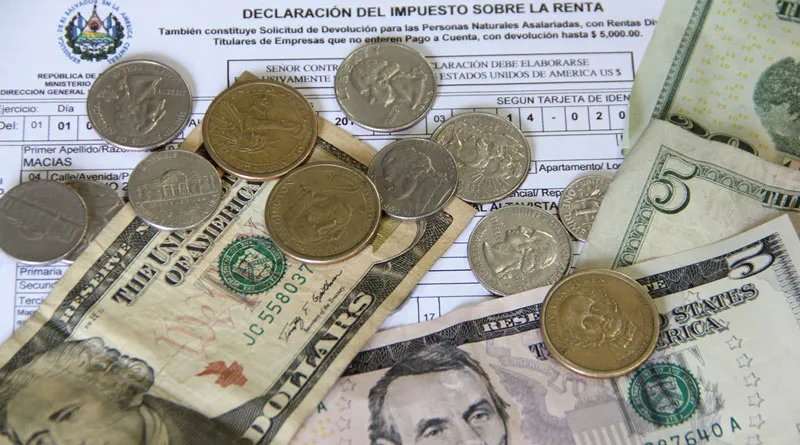

El Salvador’s Ministry of Finance expects to close the year 2024 with an increase of US$500 million in tax collection compared to the previous year. This growth is attributed to several strategies implemented by the institution to improve tax collection. According to Minister Jerson Posada, these measures seek to strengthen the country’s economy and ensure a more efficient management of public resources.

Among the actions highlighted in this strategy is the fight against tax evasion and smuggling, which have been identified as critical problems affecting state revenues. The implementation of digital technologies and tools has also been crucial, facilitating processes that were previously cumbersome and promoting transparency in tax transactions.

The Tax Amnesty is another relevant component of this plan, allowing taxpayers to regularize their situation in an accessible manner and with significant benefits. This approach not only encourages tax evaders to catch up, but also improves the relationship between the government and citizens, creating a more conducive environment for tax compliance.

Finally, the introduction of electronic invoicing has modernized the tax system, allowing for more effective tracking of business transactions. With these combined efforts, the Ministry of Finance hopes not only to increase revenues, but also to build a fairer and more sustainable system that benefits the entire salvadoran population.