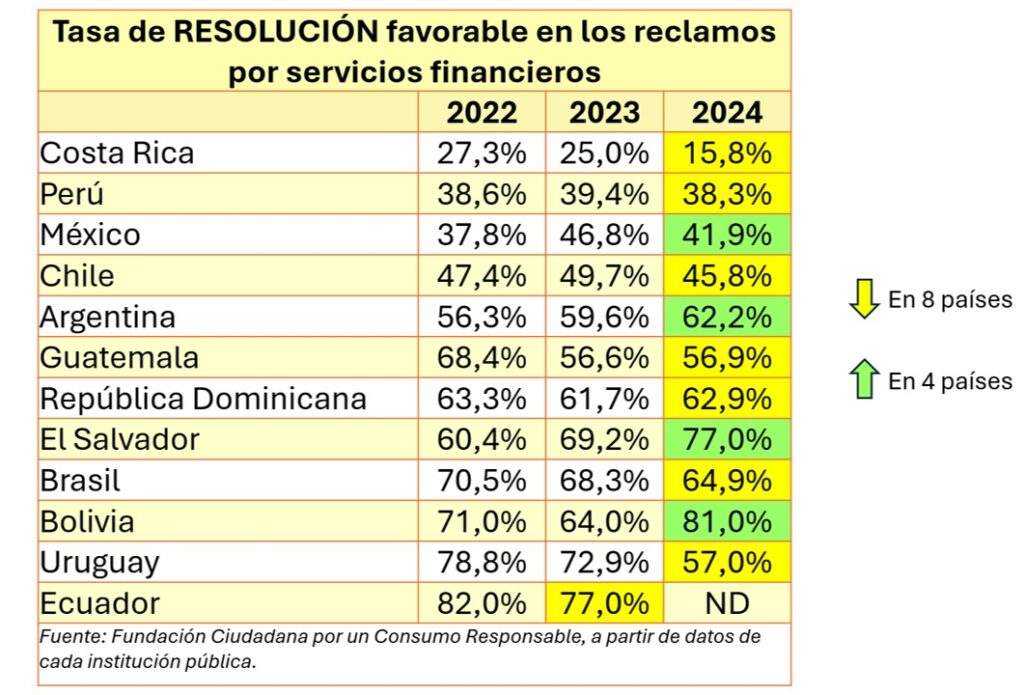

El Salvador registered a continuous improvement in its financial services claims resolution rate between 2022 and 2024, reaching 77.0% in 2024, according to data from the 2022-2024 Latin American Consumer Profile, prepared by the Fundación Ciudadana por un Consumo Responsable .

According to the report, in 2022 the country reported a 60.4% resolution rate, meaning that six out of ten financial claims were resolved in favor of consumers. By 2023, this proportion had increased significantly to 69.2%, demonstrating clear progress in the effectiveness of the customer service and resolution processes.

The positive trend solidified in 2024, when El Salvador reached 77.0%, representing a cumulative increase of 16.6 percentage points over the analyzed period. This result confirms a sustained year-over-year improvement in the institutional capacity to resolve financial claims in favor of users.

The study highlights that El Salvador is among the small group of countries in the region where the favorable resolution rate increased between 2022 and 2024, demonstrating consistent performance and positive progress in protecting the rights of financial consumers.

With this result, the country positioned itself in 2024 with one of the highest levels of favorable resolution in the region, reflecting concrete progress in handling claims and in user confidence in formal resolution mechanisms.

You can also read: