The Cámara Salvadoreña de la Industria Textil, Confección y Zonas Francas, CAMTEX, presented the sector’s trade balance and outlook for 2026 during its year-end press conference.

After a particularly challenging 2025 for the global textile and apparel industry, El Salvador is preparing for a new recovery cycle driven by the recent announcement of the trade agreement between the United States and El Salvador, made public on november 13, 2025. “This agreement establishes a framework for reciprocal trade, strengthening the bilateral economic relationship and creating better conditions for access, visibility, and competitiveness for salvadoran products in the U.S. market. This announcement represents a concrete opportunity to recover jobs, attract investment, and scale up national production”, stated Patricia Figueroa, Executive Director of CAMTEX.

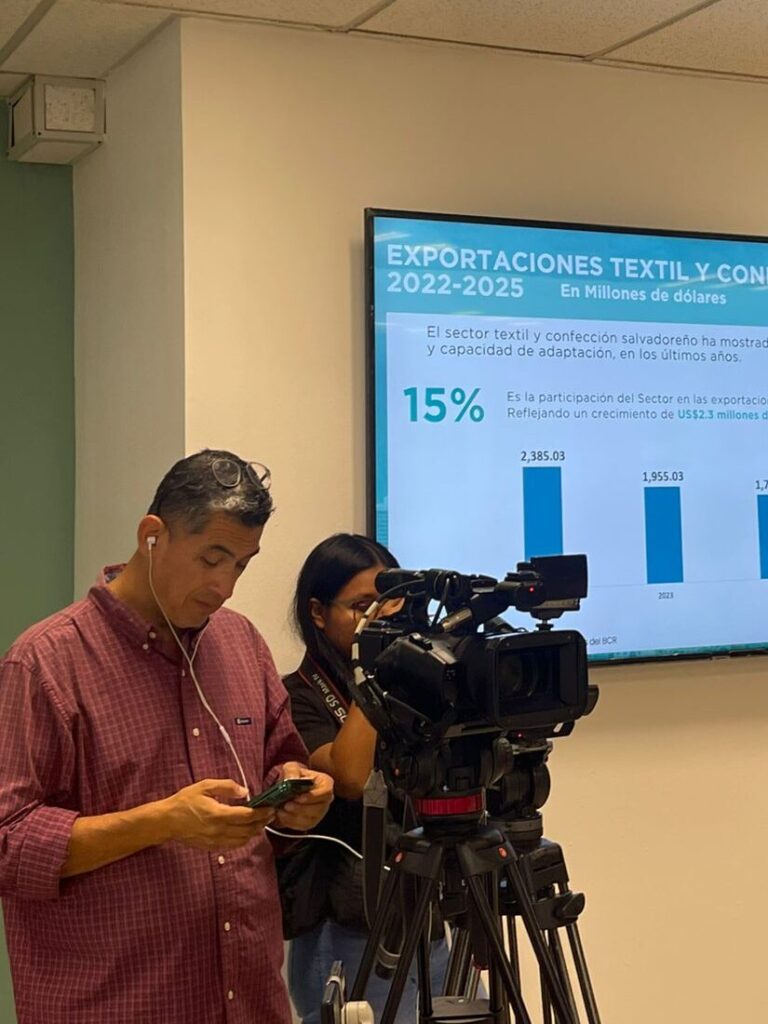

According to the trade association’s data, sector exports fell by 4.6% as of october 2025, highlighting that the rate of contraction is slowing: -18% (2023), -9.8% (2024), -4.6% (2025). However, this new trade agreement would give us a clear advantage over Asia and allow us to return the sector to growth. Among the most relevant measures in the bilateral announcement is the elimination of tariffs, a key adjustment that seeks to strengthen the continuity of a strategic supply chain for North America. However, we are awaiting the formalization and signing of this agreement.

The decision benefits the entire chain: spinning, weaving, dyeing, garment manufacturing, logistics, and value-added services such as garment design, screen printing, and full-package services, among others.

The new trade environment also opens doors to greater investment in clean technologies, energy efficiency, circular processes, and the production of high-value-added niches such as technical apparel and performance wear.

“After a challenging year, this trade framework brings clarity, stability, and a real platform for growth. The United States remains our most important strategic partner, and this decision reaffirms the importance of El Salvador within its supply chain, where years of trust and partnership with the U.S. textile industry have allowed us to preserve jobs in both countries”, the industry leader emphasized.

Despite industry restructuring, the sector remains strategically important for El Salvador’s development, accounting for US$1.6823 billion in foreign exchange as of october of this year. This represents 30% of the country’s total exports and generates more than 60,000 direct and 120,000 indirect jobs.

During the event, the trade association highlighted the competitive advantages of the salvadoran industry compared to competitors from other hemispheres: nearshoring, responsiveness, stability, and alignment with the values of sustainability, trust, and transparency held by american consumers.

Currently, 8 out of 10 member companies of the association operating in El Salvador export their products to the United States.

In this scenario, El Salvador stands out for its geographic proximity, vertical integration, technical capacity, and a supply chain that has demonstrated resilience even during periods of major logistical disruption.

To date, the country has an industrial floor area of 334,275 m2 and a total of 19 free trade zones that produce for more than 25 countries. Their level of technology and compliance allows them to hold international certifications such as Blue Sign, SAC, WRAP, OEKO-TEX, and ISO. In the North American market, the country is the 11th largest supplier of apparel, a position it has maintained among the top 20 suppliers.

Furthermore, industry representatives indicated that new investments are expected during the first quarter of next year to strengthen the sector’s production chain, which will contribute to boosting the labor market and local manufacturing output.

You can also read: