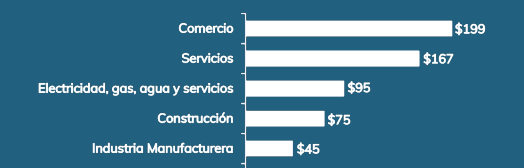

As of june 2024, El Salvador’s economic segments experienced notable growth in credit allocation, with commerce leading the expansion. According to data from the Superintendencia del Sistema Financiero (SSF), credit to the commercial sector increased by US$199 million, representing an 8.4% y-o-y growth.

The services sector also showed significant progress with an increase of US$167 million, equivalent to 12.8%, according to the “Financial Performance” report of the Asociación Bancaria Salvadoreña (ABANSA).

Another sector that stood out was electricity, gas, water, and related services, which showed an increase of 16.1%, adding US$95 million more in loans. This dynamism in key sectors of the economy could boost the country’s economic growth, resulting in the creation of more jobs and greater competitiveness.

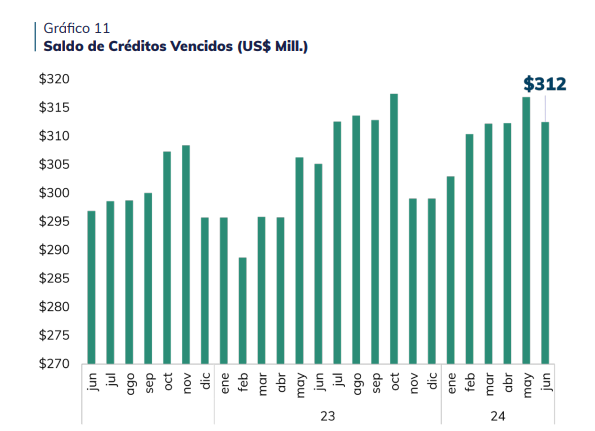

The balance of past-due loans reached US$312 million in june 2024, a value that banks have tried to keep under control through internal efforts. Despite the increase compared to previous months, financial institutions continue to focus on minimizing this indicator in order to guarantee the stability of the credit system.

It should be noted that the growth in the allocation of loans and the control of overdue loans reinforce the role of banks in supporting the economic development of El Salvador, with expectations that these movements will generate a positive impact on productivity and employment.