Latin America and the Caribbean stand out for their rapid progress in the adoption of digital accounts. According to the Global Findex 2025, report, 37% of adults in the region already have a mobile or digital money account, a significant jump from the 22% recorded in 2021. This growth reflects how mobile phones and the internet are transforming the way people manage their money, from savings to everyday payments.

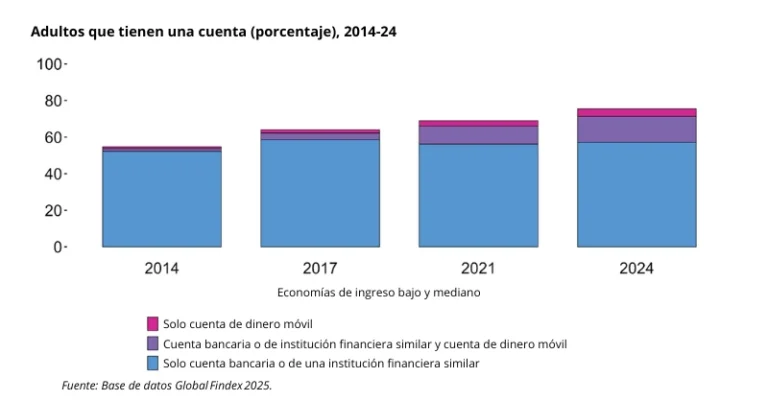

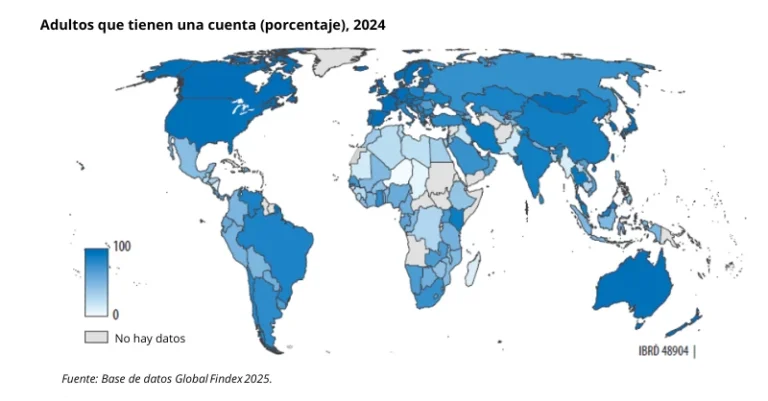

Digital technology has enabled millions of people to make deposits, payments, and transfers without having to go to a traditional bank. In low- and middle-income countries, 75% of adults already have an account with a financial institution or mobile money provider. These tools are more accessible, secure, and affordable, boosting economic independence and promoting greater participation in the formal economy.

However, the report also warns that 1.3 billion adults worldwide still do not have a financial account, even though 86% of them own a mobile phone. This means that millions of people have the potential to access digital services, but still face barriers such as a lack of connectivity, financial knowledge, or adequate infrastructure.

Experts emphasize that expanding financial inclusion depends not only on technology, but also on creating a safe and secure environment. This includes strong consumer protection, interoperable payment systems, and products designed for the needs of the most vulnerable.

With the right support, digital financial services can become a gateway to economic development and reducing inequality in Latin America. Digital inclusion not only connects phones, but also opportunities for millions of people seeking to improve their quality of life.

Read also: