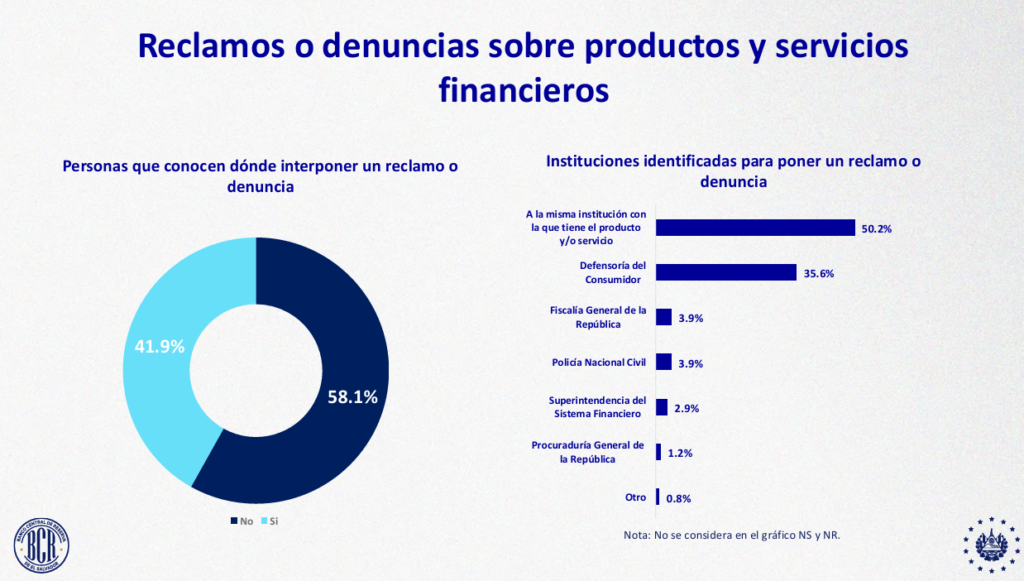

58.1% of people in El Salvador don’t know where to file a complaint or report when they face problems with a financial product or service, a figure that highlights a significant gap in information and financial education in the country. The data reveals that more than half of the population lacks clarity about the formal channels for defending their rights as users of the financial system.

According to the results of the Encuesta Nacional de Inclusión y Educación Financiera, conducted by the Banco Central de Reserva (BCR), this lack of knowledge limits people’s ability to demand solutions to improper charges, breaches of contract, or malpractice by financial institutions. In practice, this can translate into financial losses, unnecessary debt, or resignation in the face of situations that do have avenues for resolution.

The study also reveals the other side of the coin: only 41.9% of the population claims to know where to file a complaint or grievance. This group, although a minority, has greater resources to protect their personal finances and exert pressure on entities to comply with current regulations.

Among those who identify an institution to file complaints with, 50.2% indicate they would go directly to the same entity with which they have the financial product or service, reflecting that the first reaction is usually to seek an internal solution. In second place, 35.6% mention the Defensoría del Consumidor as the body they would turn to for filing a formal complaint.

Other institutions appear with considerably lower percentages. The Fiscalía General de la República and the Policía Nacional Civil are each mentioned by 3.9% of respondents, while the Superintendencia del Sistema Financiero is identified by 2.9%. The Procuraduría General de la República reaches only 1.2%, and 0.8% mention other agencies.

The results reflect that, although multiple institutions are responsible for protecting financial consumers, their roles and functions are not fully understood by most of the population. This situation underscores the need to strengthen financial education, not only on topics such as savings, credit, and insurance, but also on consumer rights and complaint mechanisms.

The Banco Central de Reserva (BCR), emphasizes that improving access to information and promoting awareness of these institutions can contribute to a more transparent and balanced financial system, where consumers feel supported and have greater confidence in using financial products. In this regard, reducing the 58.1% lack of financial knowledge is key to advancing toward more effective and equitable financial inclusion in El Salvador.

You can also read: