The study was made through a digital tool to more than 1600 people, the data was collected from january 2020 to september 2021, mostly employees, 60% with salaries below $1,000.

Among the results of the study, it is concluded that 34% of people say they use a budget for their expenses. 62% of the sample said they save. Of this total, 33% save less than 10% of their salary.

When asked how long they would be able to survive in the event of losing their main source of income, 48% of people say that they could survive for 2 months if they lost their main source of income. At the extreme end of the scale, 20% of people said that they would not survive even a week in this situation.

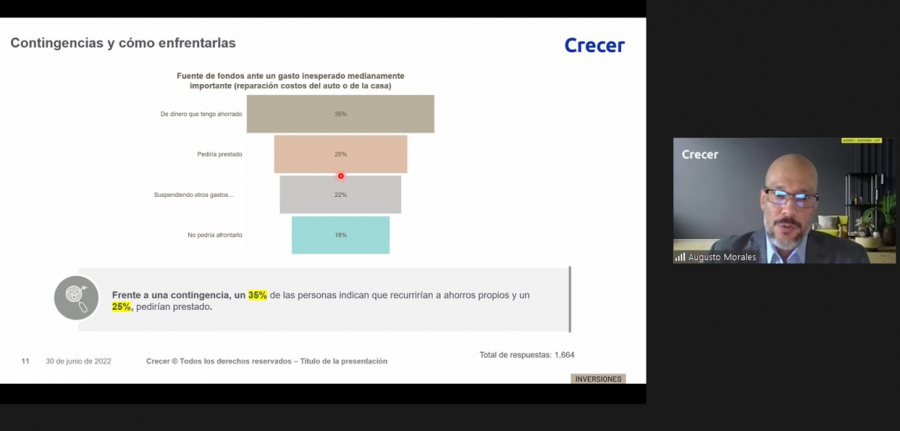

Additionally, in the event of a contingency such as the one mentioned above, 35% of people indicated that they would resort to their own savings to face it, 25% would borrow and 18% would not be able to afford it.

The study reveals other behaviors of people when faced with large purchases. Thirty-two percent say they evaluate the expense to be made versus their available funds. Another group of the same size, 32%, say they evaluate these purchases thinking about leveraging debt, considering the amount of the installment to be paid against their income. Finally, 23% say they make no major considerations when making a significant purchase.

The habit of analyzing personal finances continues to be a challenge for most salvadorans, since the majority (52%) of the participants in the diagnostic mentioned not having had the time to analyze their financial situation.

"As an expert in savings and investments, we have the ability to conduct these studies to find ways to support our clients and people in general, and we do so by providing tools, enabling people to make good decisions to better manage their personal finances, take control of their situation and build a better present and future wellbeing. The findings of this and many other studies we have conducted have allowed us to create various support actions that we encourage our clients to use in this way to learn how we can contribute to strengthening a culture that allows them to enjoy financial health", said Crecer's Commercial and Marketing director, Augusto Morales.

Crecer delivers enabling tools

In order to support and encourage its clients and salvadorans to advance in good financial health practices, Crecer created and develops the financial education program "Tiempo con tus Finanzas".

The program has the components of more than 20 content capsules hosted on the company's youtube channel, sending mailing with tips to the customer database, a series of publications on social networks and a series of digital talks with the ally Mario Magaña (Mario Financiero).

"Our program has already reached more than 3.5 million people between january and may 2022. Additionally, we have a new savings solution and digital tools that allow people to consider scenarios and, in that process, if they are interested, receive savings and investment advice", emphasized Morales.

English

English  Español

Español