El Salvador has now converged with B/BB split-rated credits like The Bahamas and yields of 11% -12% are perhaps a few points away from fully normalizing for accessing Eurobond markets.

The recovery in asset prices was due to a series of policy measures that ultimately show a commitment to honor debt payments.

There are still unresolved solvency risks related to the 2% of GDP fiscal deficit and high debt stock; however, the potential to expand access to financing would provide greater flexibility that could validate a virtuous circle and reduce the risk of default.

What has happened in recent weeks?

According to Santander Corporate & Investment Banking, the incumbent's investment in Google was the obvious trigger. The investment itself is not transformative; however, it does suggest the potential for higher IED and a significant reversal of negative net IED by 2022.

It also suggests the potential for an alternative high-tech growth model, the obvious extension of the BTC launch two years ago. There is no quick fix for trend GDP growth of 2% to 3%, but efforts to seek foreign investment reaffirms already positive intentions to honor debt payments and implement investor-friendly policies.

In addition, it was the main agreement with local banks to further develop local bond markets by extending maturities from 1A-2A to 7A in debt auctions. The longer maturities should further reduce already low refinancing risks and immunize against potential shocks.

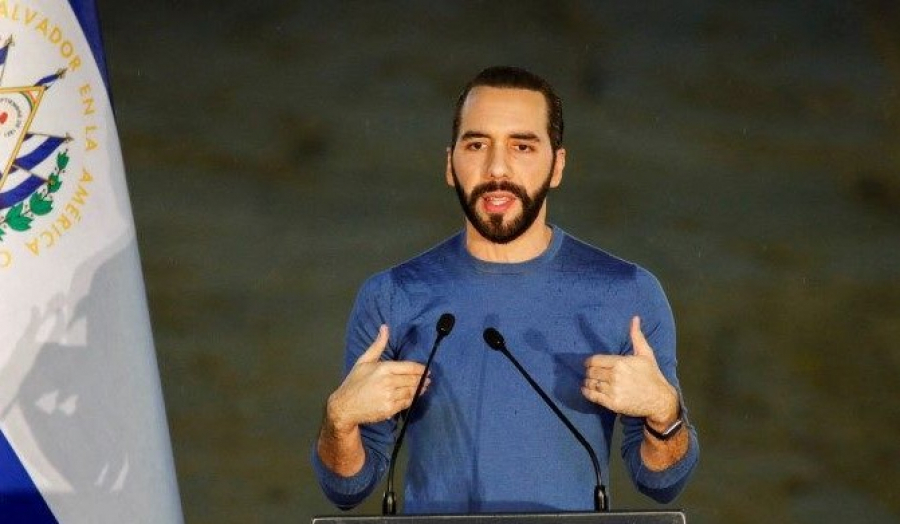

Santander Corporate & Investment Banking's conclusion is that the Bukele administration is now consistently showing a market-friendly approach to policy management that further reaffirms the willingness to pay after last year's significant Eurobond debt buybacks.

The smooth payment schedule initiated the second phase of outperformance earlier this year on liquidity relief and low event risk. There was also a significant consolidation of the fiscal accounts, which improved from a pandemic deficit of 9.1% of GDP in 2020 to a near normalization of the deficit to 1.8% of GDP in 2022.

This virtuous circle on asset appreciation in itself could soon also provide broader financing flexibility if cumulative measures open up external market access. This would not solve solvency risks, but it would again reduce funding risks that perpetuate payments for longer.

The break-even yield analysis now postpones a potential default until 2029, and current bond prices infer payments through january 2029 at the typical sovereign recovery value of 30.

There remain some voluminous amortization payments of $800 million in 2027 and $600 million in 2029, as well as the $248 million payment in 2025.

Conviction on these payment scenarios requires clarity on fiscal adjustment (2% deficit over fiscal balance) and broader access to financing (Eurobond markets or IMF) or perhaps even an alternative growth model based on tourism and the high-tech sector (IED tracking as a leading indicator).

Translated by: A.M

English

English  Español

Español